Hey there!

Just trying out a new inflation report email – would be great to get your thoughts!

As always, just click on the report pictures to have a closer look. 🔍

And don’t forget to follow us on X!

Enjoy!

The inflation print for March just hit the tape, so let’s dive right in!

Here are the headline prints:

Year-over-Year:

✅ *US MARCH CPI RISES 2.4% Y/Y; EST. +2.5%

✅ *US MARCH CORE CPI RISES 2.8% Y/Y; EST. +3.0%

Month-over-Month:

✅ *US MARCH CPI FALLS 0.1% M/M; EST. +0.1%

✅ *US MARCH CORE CPI RISES 0.1% M/M; EST. +0.3%

For a complete breakdown of last month’s CPI, check out our dashboard!

CPI – Year-over-Year

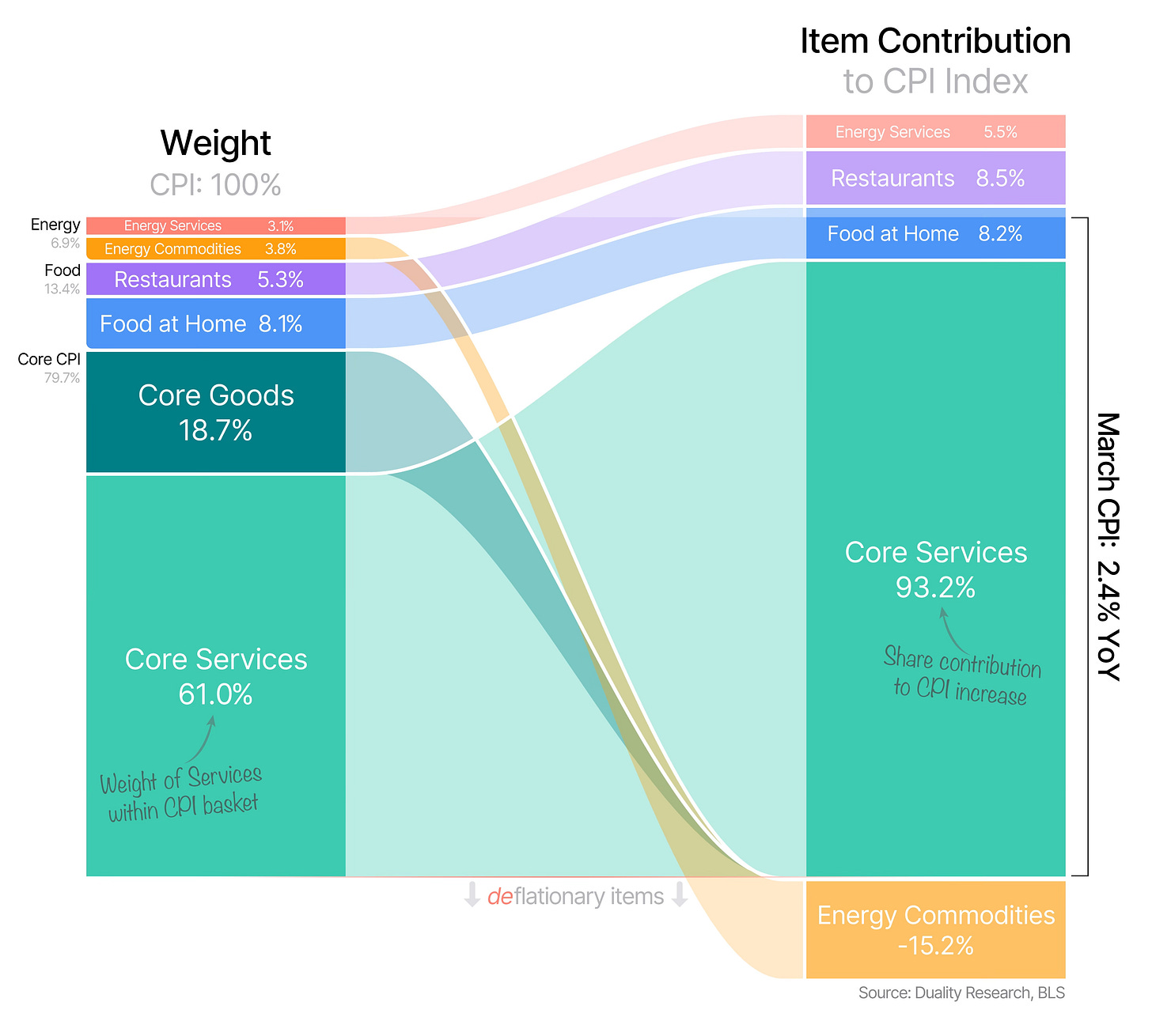

Let’s start with our chart that shows the weight of the 3 main CPI categories and their respective sub-groups on the left. On the right, you can see how each item contributes to the overall index.

(see February CPI)

Next up, we’ve got 2 charts breaking down Core CPI – one showing year-over-year (YoY) changes and the other highlighting month-over-month (MoM) shifts, focusing on items with the most disproportionate impact.

Core CPI – Year-over-Year

Core CPI – Month-over-Month

March’s CPI and Core CPI both came in lower than expected!

Core CPI rose just 0.06% MoM, with the increase notably dampened by significant declines in Car Insurance and Airline Fares.

It’s still clear that most of the “excess” inflation is still coming from Shelter and Car Insurance.

As we’ve discussed multiple times before, official Shelter data lags way behind what real-time private market data shows.

Basically, today’s numbers still include rent hikes from 15 months ago.

But since real-time housing data is still below the Fed’s 2% target (per WisdomTree), we want to strip that out and here’s what we get:

CPI without Shelter is up 1.5% YoY vs 2.4% for CPI.

Core CPI without Shelter is up 1.8% YoY vs 2.8% for Core CPI .

Let’s remember, the Truflation index tends to lead by at least 45 days.

Like we said last time, this report is still just one of the first to catch the big price drops we’ve been seeing on the Truflation index.

So, if Truflation’s on point, there should be plenty more soft prints ahead!

Let’s see.