Don’t Confuse Volatility with a Trend Reversal

Thoughts on the Market

The tone shift we saw last week was a direct response to index behavior. But contrary to what many think, opportunities aren’t disappearing — they’re just shifting.

The story hasn’t really changed: Tech is weighing on the S&P 500, while market breadth continues to expand.

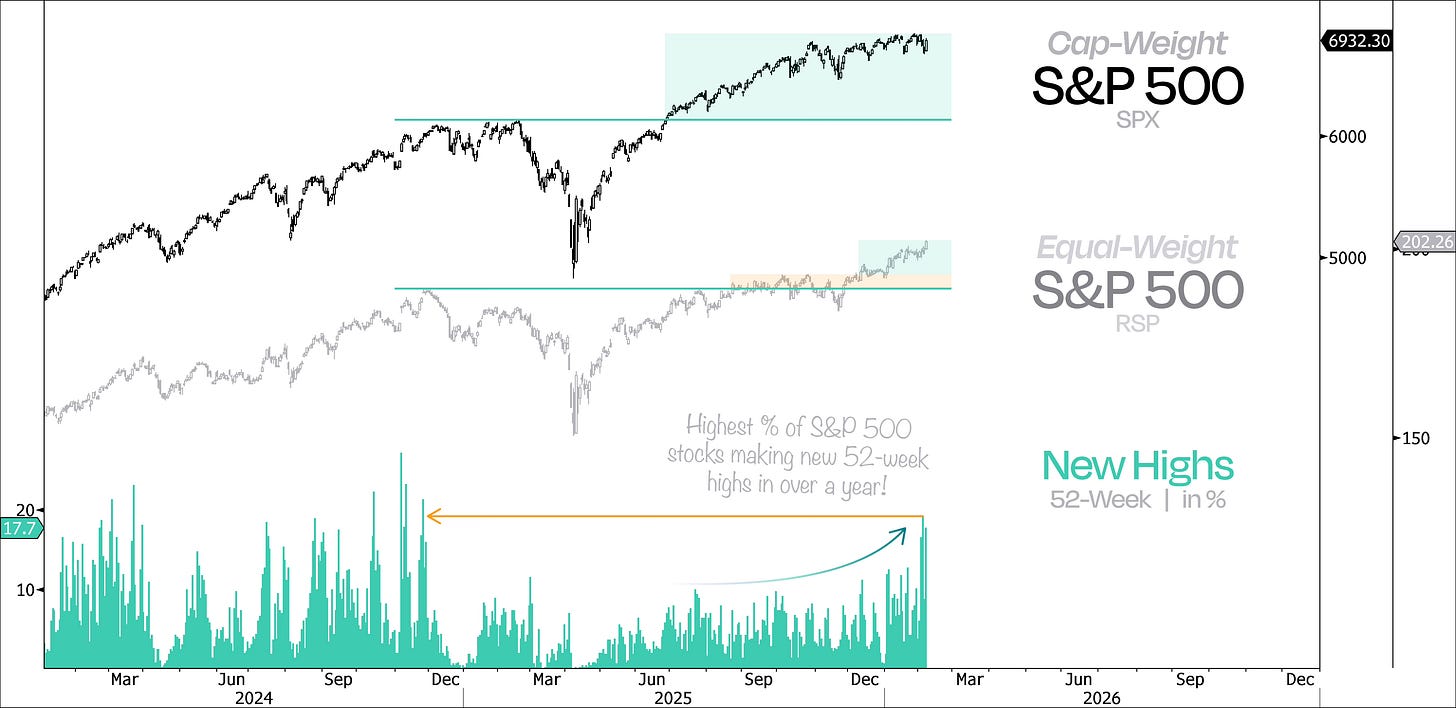

Just last week, the S&P 500 recorded the most new 52-week highs since 2024, on a day that was likely the worst since Liberation Day for many investors.

The irony is that new highs keep piling up, even though most portfolios have yet to top their October 29 peaks.

Since the November reset, the market of stocks has really been doing just one thing: broadening out. You can see it clearly in the next chart through the NYSE cumulative advance-decline line and the number of S&P 500 stocks trading above their 200-day moving average.

Now, if you look back at how the S&P 500 peaked a year ago, both breadth measures were already rolling over, printing lower highs ahead of the index top. Right now, we are seeing the exact opposite.

In our view, these two charts don’t just show breadth expanding — they serve as evidence that this is sector rotation. After all, most bear markets don’t start with so many stocks hitting new 52-week highs.

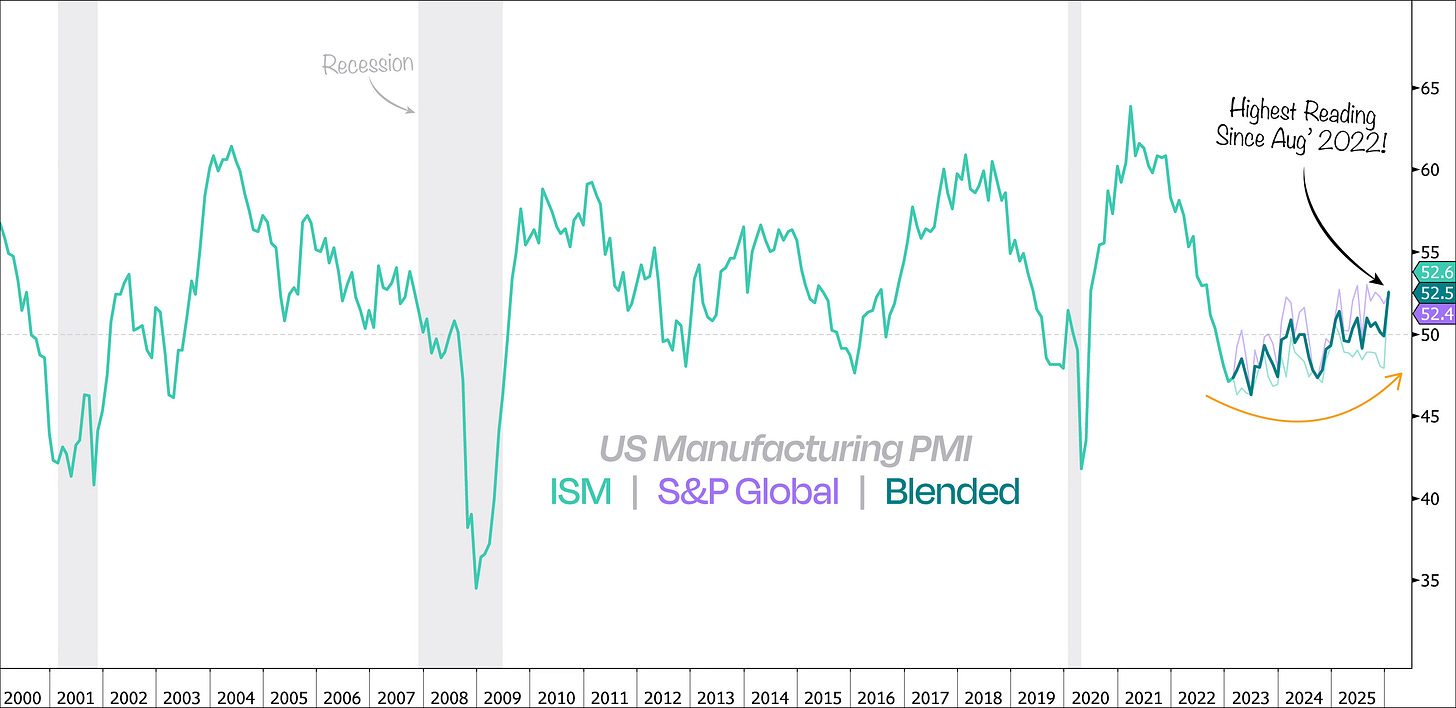

For us, the reason this market is broadening is simple: the economy is reaccelerating — like we’ve been saying for months.

On top of that, financial conditions are easing and pro-cyclical deficits are about to give it a boost, which is exactly why we’ve been in the small-cap trade for a while now.

Finally, you can see it in the data, too — last week’s ISM print basically screamed reacceleration. The long-term chart below puts it in perspective, showing the ISM Manufacturing PMI since 2000, along with the average of the ISM and S&P Global US Manufacturing PMI since 2023.

The business cycle is just getting started — but thanks to the AI trade, this bull market got a 2-year head start.

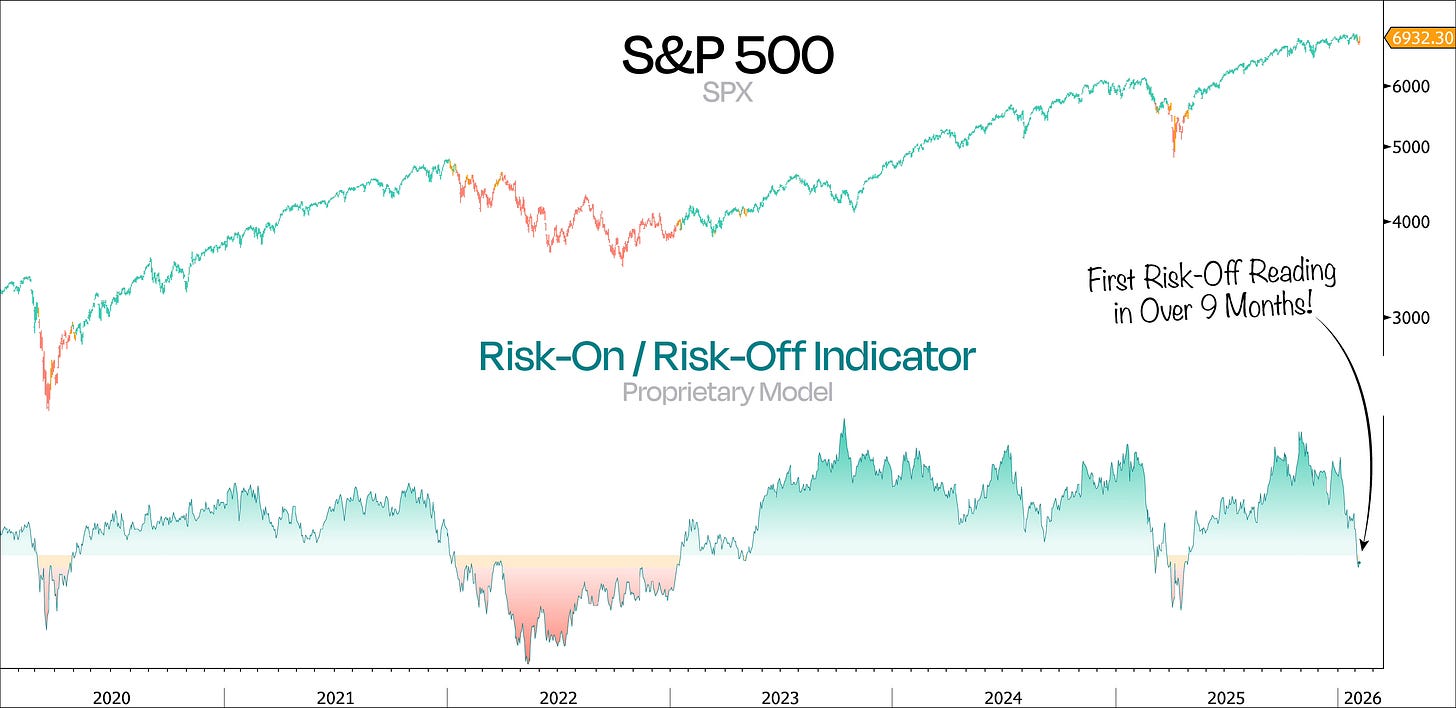

Now, while all of this sounds good, something bigger is clearly going on beyond just Tech’s weakness. After all, our Proprietary Risk Appetite Model flipped to risk-off last week for the first time since April 2025, as our chart below shows.

Like we said last week, that vertical spike in Staples has been a red flag. Add crypto getting wiped out and high-beta stocks lagging low-vol names, and it’s clear — investors aren’t exactly lining up to take on risk right now.

For us, the main culprit is concentration. With Tech making up a massive 33% of the S&P 500, any rotation out of the sector can hit portfolios hard, especially for passive investors. Our friend Larry Thompson summed it up perfectly: rotation isn’t the lifeblood of the bull market anymore — it’s the death of the S&P 500.

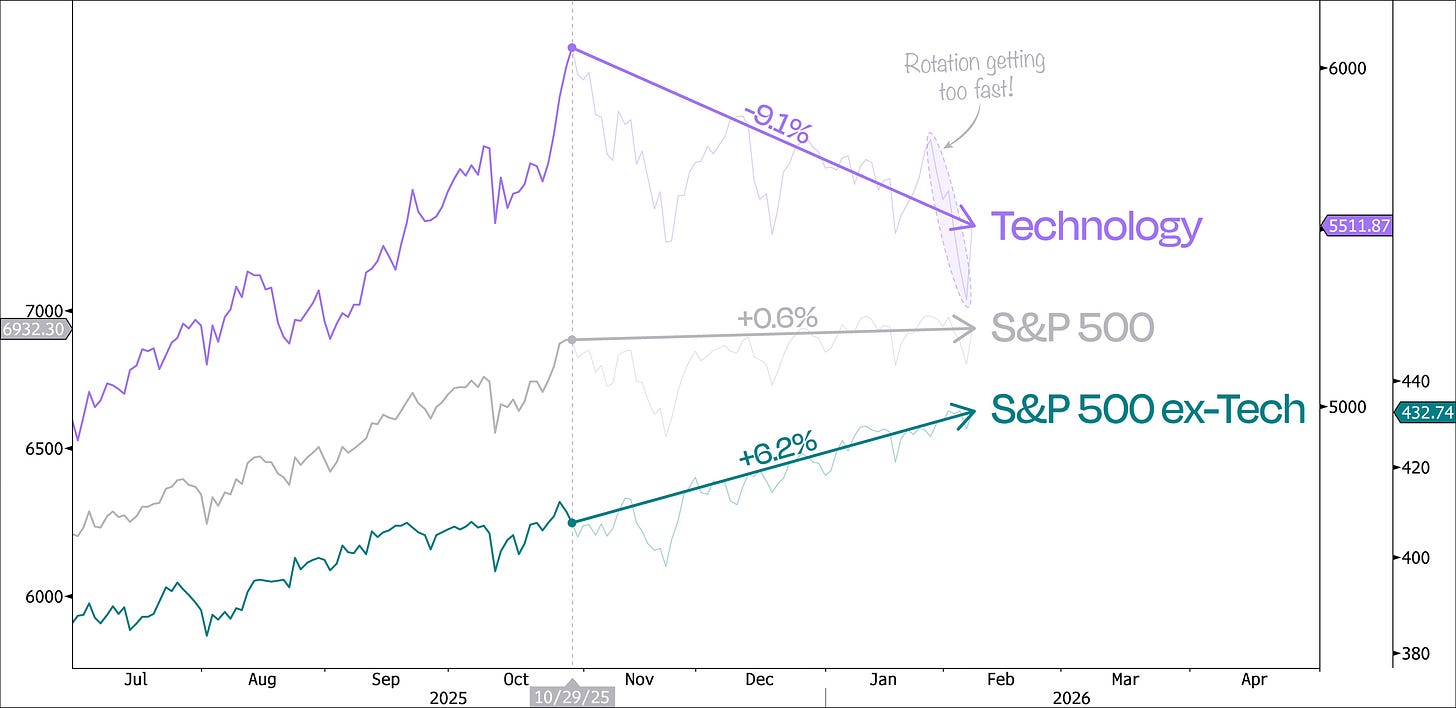

That said, the next chart suggests rotation out of the massive Tech sector doesn’t have to obliterate the whole market. The S&P 500 has been basically flat since October 29, as the rest of the market made up for Tech’s losses.

The real danger — what we got to feel last week — comes when the pace of rotation picks up. Normally, when other sectors fall out of favor, it doesn’t spill over into the broader market. But that’s not the case with Tech. With it making up a third of the market, an 8% drop in just six sessions is enough to shake everything.

Broadly speaking, we think the selloff in Technology ran a bit too far — especially as markets appeared to outright de-risk on a narrative that Fortune 500 companies would abandon platforms like Salesforce in favor of in-house CRMs vibecoded by 13-year-olds.

If that’s the case, why stop there? Why not build their own offices, machines, desks — and maybe start stitching employee uniforms and shoes while they’re at it? After all, if there’s one thing executives love, it’s adding complexity.

Jokes aside, most companies have zero desire to become software companies, even if AI makes it easier than ever. They’ll keep paying for software — just to fewer vendors that actually get AI right. This is a consolidation story, not an extinction event.

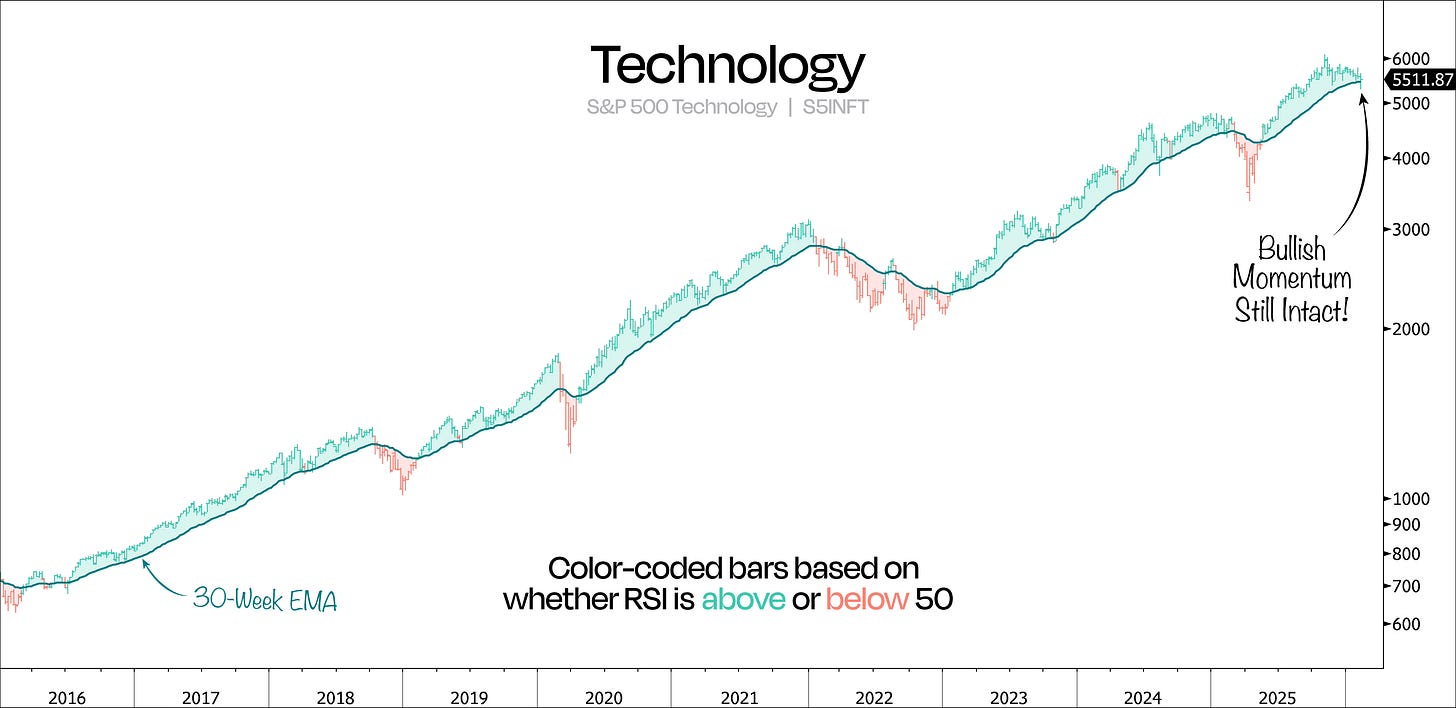

As for Friday’s bounce, it’s hard to say whether that was the market coming to its senses or just a textbook oversold rally — probably the latter. Either way, Technology bounced at an important level and, for now, remains in bullish momentum territory, with weekly RSI above 50, which also lines up pretty closely with whether price is above or below the 30-week EMA.

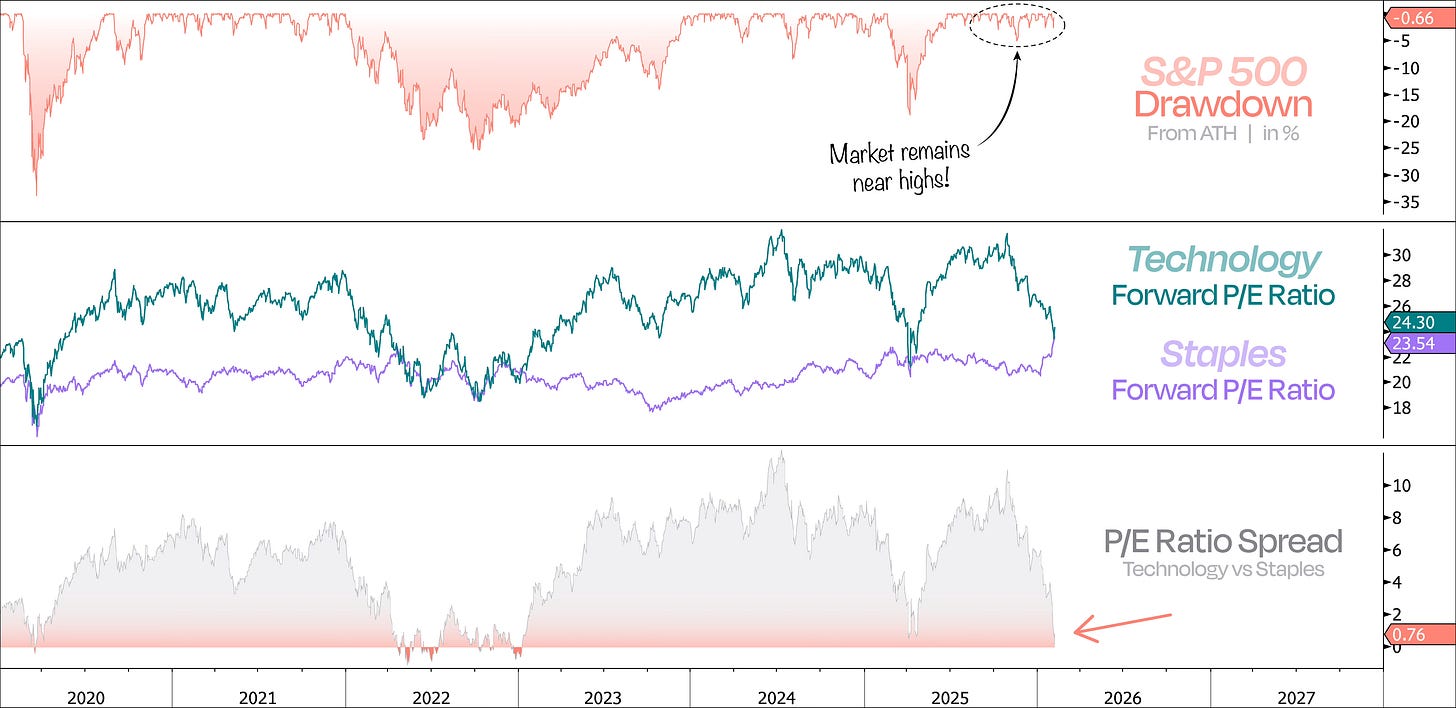

Another way to see how far the pendulum has swung is by comparing valuations in Tech vs Staples — keeping in mind we’re still in a bull market.

After an 8-point compression in Tech’s P/E, the two sectors are now trading at similar multiples, something we usually only see around major market drawdowns, as the chart below shows.

What makes this stand out is the gap in growth and profitability. Tech is expected to grow earnings by around 30% this year, with margins near 31%. Staples, by contrast, are expected to deliver about 5% earnings growth with margins closer to 7%.

Against that backdrop, the only way to justify holding defensive Staples at these historically high valuations — now more expensive than the S&P 500 — is if you’re betting on a serious recession. That’s certainly not our base case.

So, where does that leave us?

What the market just showed is that rotation out of Tech is not about how far it can fall before spilling into the rest of the market — it’s about how fast it can happen.

Last week, the move was simply too fast for the weakness to stay contained.

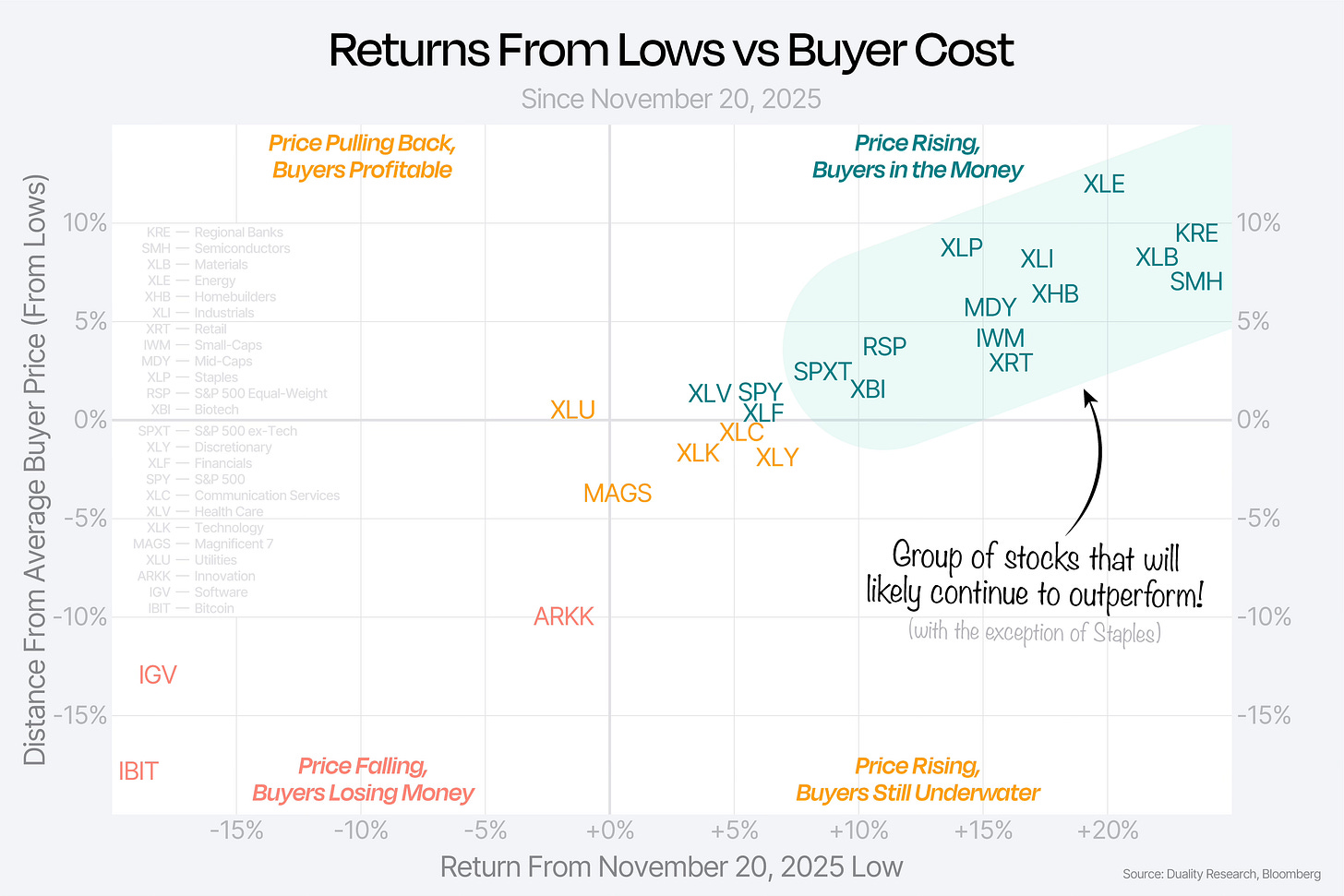

The upside is that the shakeout did some much-needed cleanup. The momentum crash flushed out excesses and reset the market for a healthier next leg.

Near term, the oversold pockets since the November 20 reset should bounce harder. But over the next six months, we still like the parts of the market tied more closely to the real economy. Think small-caps, Industrials, Regional Banks, Homebuilders… and really anything equally weighted.

Broadly speaking, the market is in good shape. The economy is reaccelerating, financial conditions are loosening, and pro-cyclical fiscal deficits should continue to act as a tailwind for this bull market.

That said, it will be important to keep a close eye on what is shaping up to be one of the larger rotations out of Technology in quite some time.

Still, we’ll leave you with the same reminder we ended last week’s note with: don’t confuse volatility with a reversal of the broader bullish trend. That’s often how investors end up getting trapped!

♟️ Duality Research — Market Playbook Status ♟️

Keep reading with a 7-day free trial

Subscribe to Duality Research to keep reading this post and get 7 days of free access to the full post archives.