Hawkish Credentials, Dovish Outcomes

Thoughts on the Market

January is officially in the books — long as ever, but a small price to pay since the rest of the year slips away in a blink.

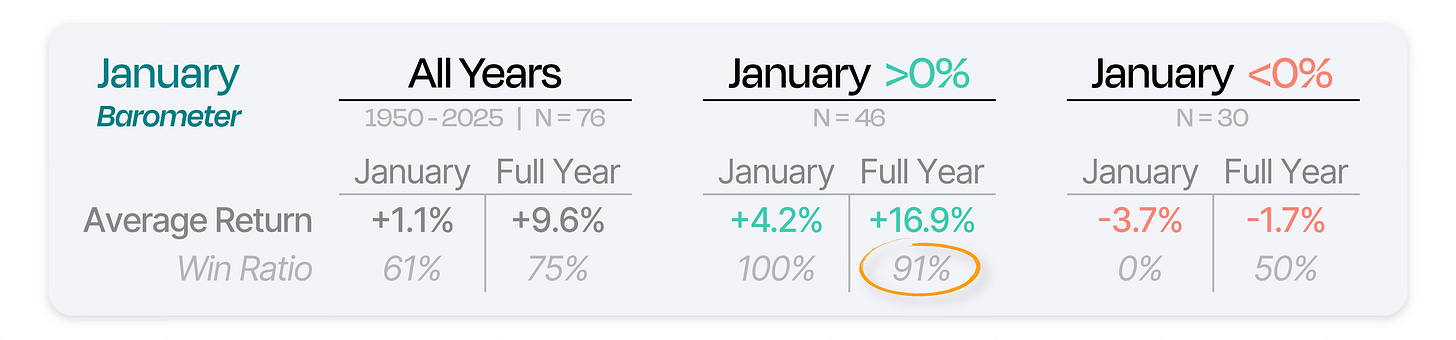

Of course, the great news is that the S&P 500 ended January up 1.4%, lighting up a bullish signal: As January goes, so goes the rest of the year.

The historical data shows that stocks tend to hold onto early gains with a solid win rate. But really, this age old indicator has a tendency to work because it simply tells us what kind of market we’re in.

So, here’s the catch – it’s not just about January. The same logic applies to any month.

Markets trend – it’s that simple! If one month is up or down, chances are the ones that follow will be too.

As we move into February, earnings season is about to get busier — and so far, corporate America is delivering.

With more than a third of the S&P 500 having reported, this earnings season is shaping up to be another one of solid performance and upside surprises.

So, here’s the rundown:

So far, 165 companies have reported. About 79% beat earnings estimates, with an average 9.3% upside surprise, pushing year-over-year earnings growth to 15.3%.

Not bad for an economy that plenty still think is slowing.

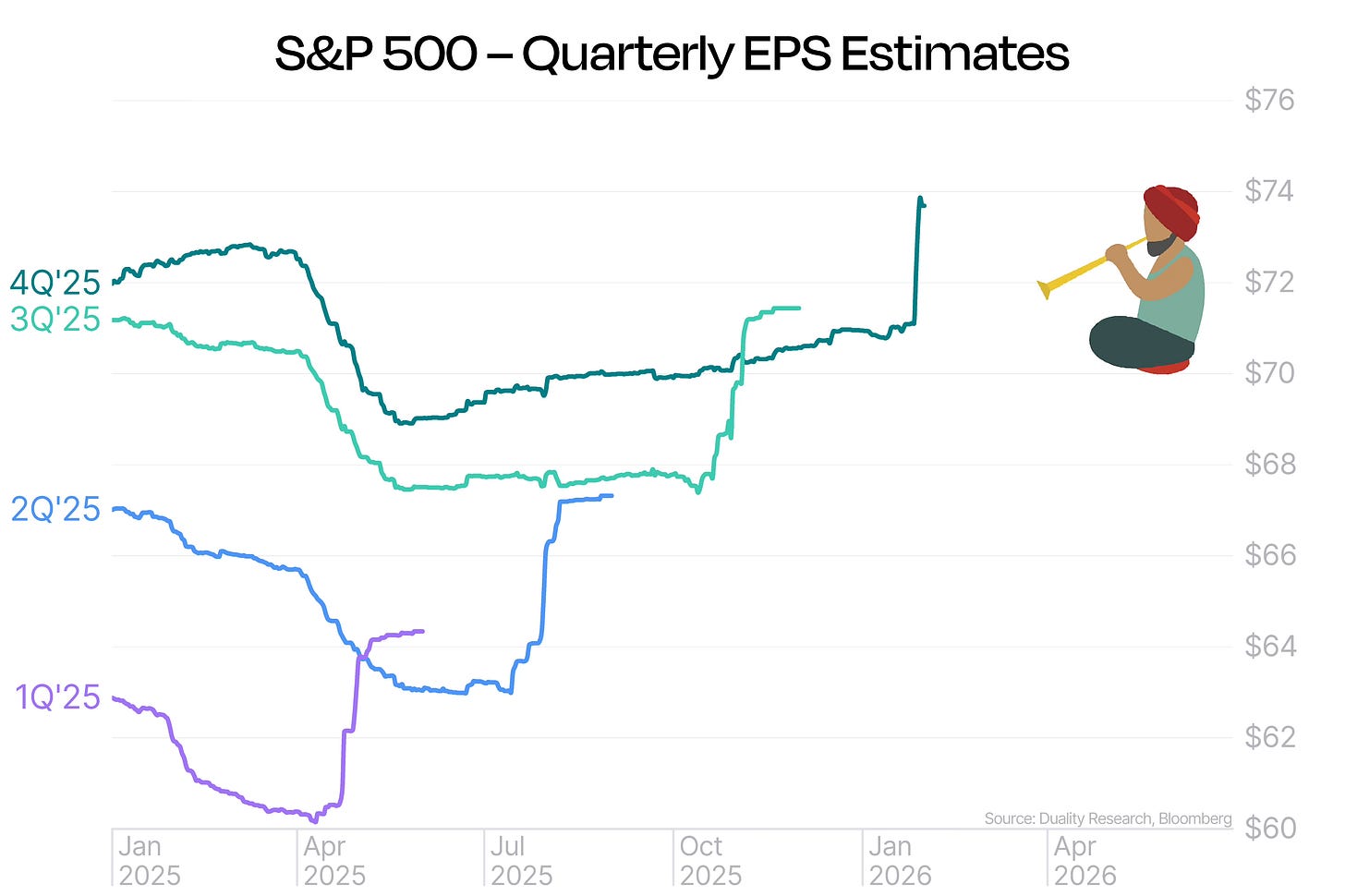

Heading into the season, the Street was looking for 8.3% earnings growth, or about $71.7 per share for the S&P 500. But with revisions trending higher, we now look on track to finish closer around $75 (≈13% YoY).

Fair to say the Snake Charmer is at work again!

Right now, forward earnings are growing so fast that for every week the S&P 500 sits still, the market actually gets a little cheaper — about 0.3% per week. Keep it flat for a month, and valuations drop roughly 1.2%.

Stretch that out to the rest of the year, and a flat market from here on out would make stocks about 12% cheaper. So, just to hold today’s valuation — around 22x forward earnings, which isn’t crazy at all given record-high profit margins — the market would still need to rally about 13% into the end of the year.

Bottom line: earnings are still a clear tailwind for stocks in 2026.

At the end of the day, where stocks finish the year will mostly come down to the multiple investors are willing to put on earnings that are still coming in strong. After all, we see limited risk of a meaningful disruption to the earnings trajectory itself.

As we’ve said many times before, today’s index composition and earnings structure allows the market to trade around 22x-24x forward earnings. But of course, multiples don’t live in a vacuum. Geopolitics, trade headlines, and monetary policy will all play a big role in how generous (or stingy) investors feel as the year unfolds.

Just four weeks ago, heading into the year, we literally said:

“Let’s not get too comfortable — anything from geopolitical surprises to shakeups at the Fed could throw curveballs our way. And let’s just say Trump isn’t exactly known for keeping things predictable.”

Well… it definitely feels like we’ve already checked most of those boxes. And when we look at what has outperformed so far this year vs what has lagged the broader market, it’s clear that the risk-appetite that came roaring back after the November 20 lows has cooled off again.

Keep reading with a 7-day free trial

Subscribe to Duality Research to keep reading this post and get 7 days of free access to the full post archives.