Inside the Yield: What’s Really Moving Rates

Thoughts on the Market

August got off to a rough start, but it’s hard to say stocks are losing steam — especially after last week’s rebound.

With earnings coming in at more than double the original Q2 estimates, it’s no wonder active managers are scrambling to chase the upside instead of letting things cool off.

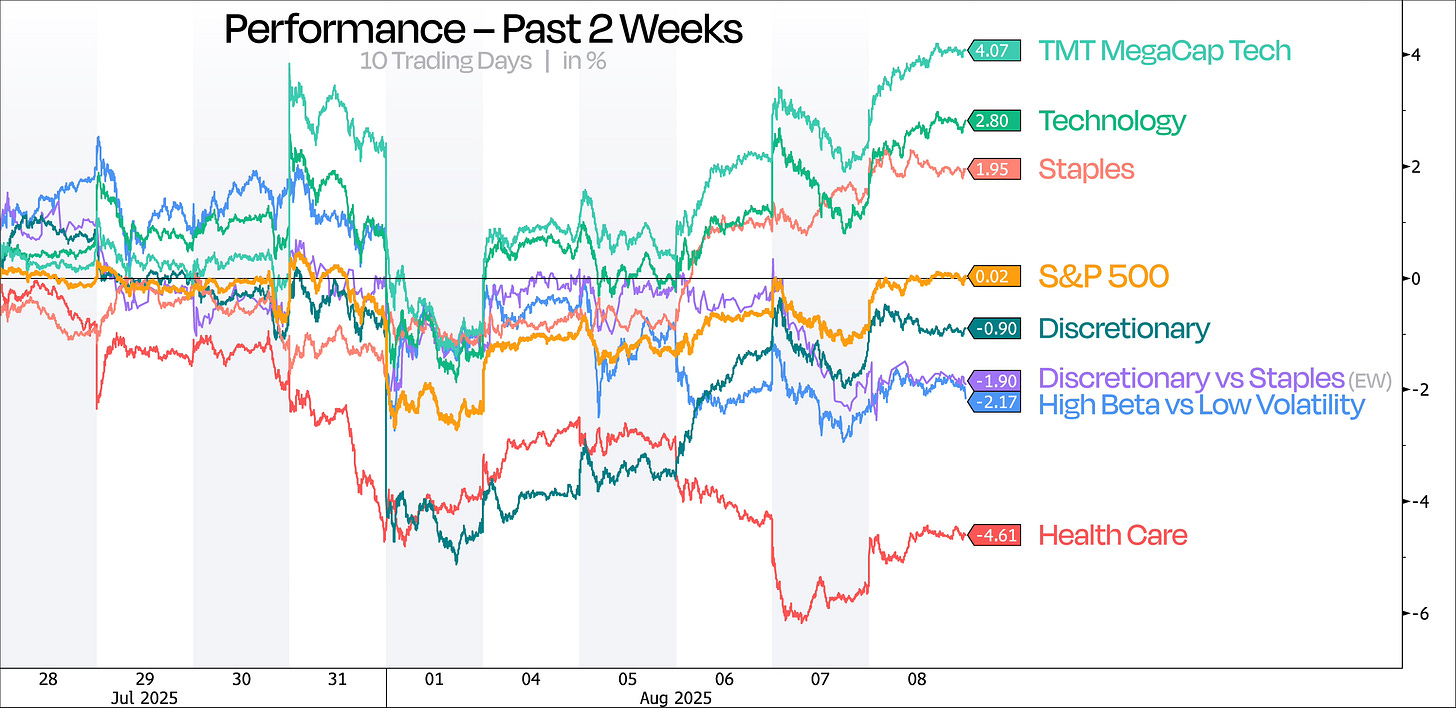

Still, when looking at performance over the past two weeks — since most stocks topped out — we’re kind of stuck in no man’s land. The S&P hasn’t made a new high, and the lack of clear leadership lately pretty much reflects that indecision.

Tech and Staples are leading the pack, but Health Care and Discretionary are dragging. At the same time, risk-on ratios are lagging the S&P 500, and high-yield spreads have started creeping off the lows. Not exactly a red flag — but not a green light either.

For now, the S&P’s uptrend channel is still intact, but with earnings season winding down, stocks are likely to start taking more of their cues from Treasury yields again.

Tomorrow’s July CPI is going to be one to watch — it’s where the Fed expects inflation to finally show up. And looking ahead, Powell’s speech at Jackson Hole in under two weeks should get plenty of attention too, especially with all the recent noise around the Fed’s independence.

On the flip side, that jobs report from two weeks back seems to have already given the green light for the long-awaited Fed pivot starting in September.

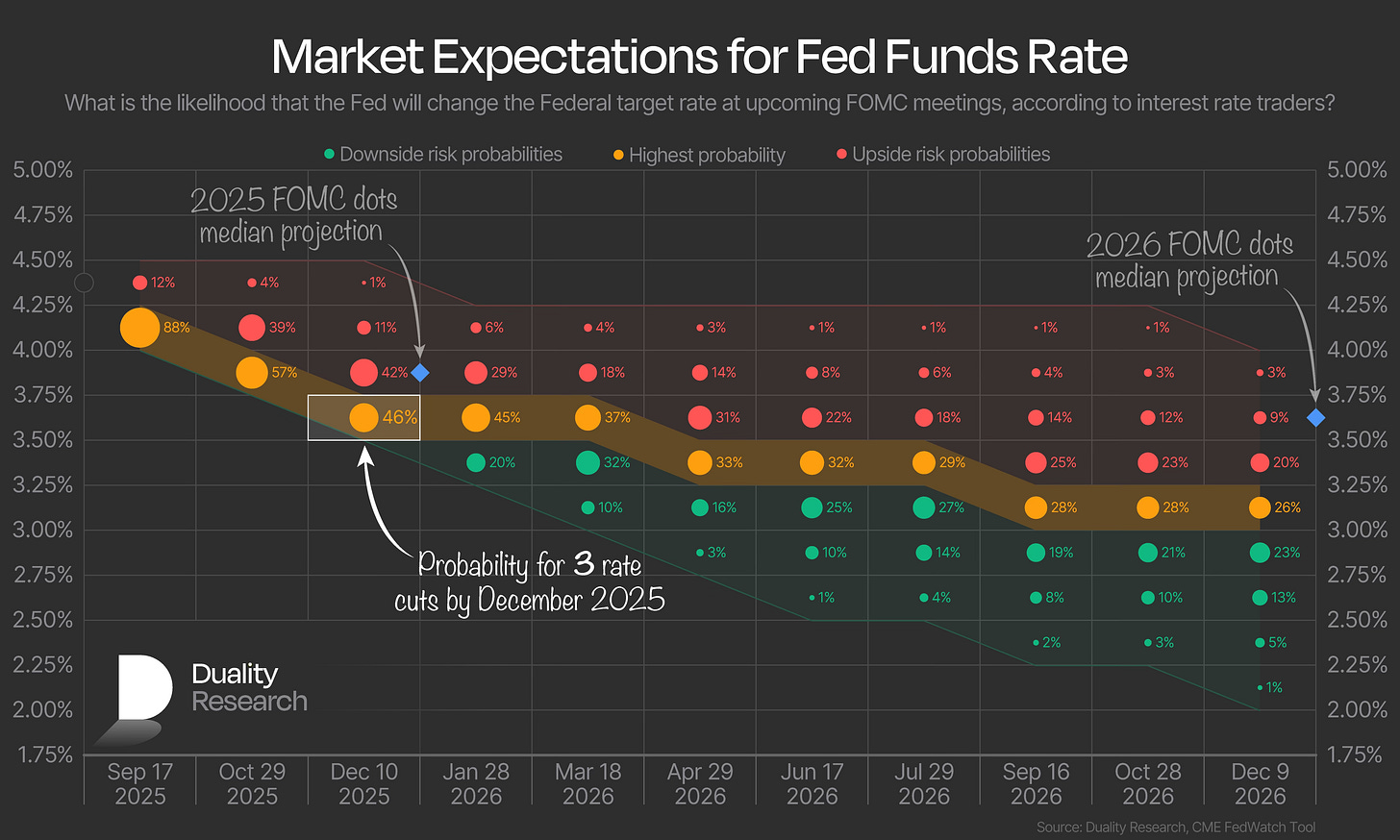

As our next chart shows, markets are pricing in an 88% probability of rate cuts resuming in September after a 9-month pause.

While the most likely scenario currently points to three cuts by the end of 2025 (46% probability), the combined odds of all other outcomes still suggest a maximum of two cuts this year.

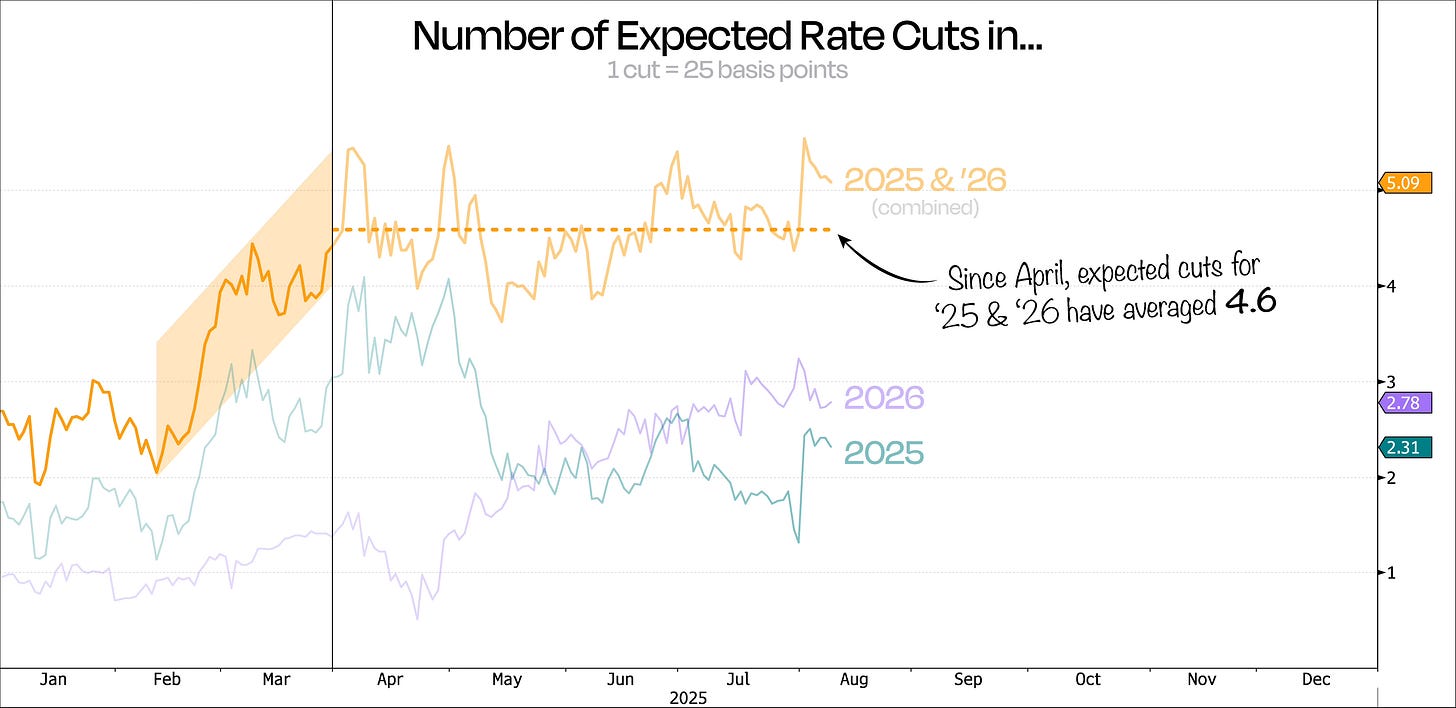

That’s quite a shift from April, when markets were pricing in four cuts during the meltdown. But part of what has kept this rally going is that those cuts were never fully priced out — they were simply pushed further into 2026.

You can see it in our next chart: the orange line shows combined expected cuts for 2025 and 2026. We can see that starting in February, markets priced in three additional cuts and haven’t really backed off since.

This brings us back to a point we made last week: for this market to remain in soft-landing territory, it still needs to expect a meaningful amount of easing — and that remains the case.

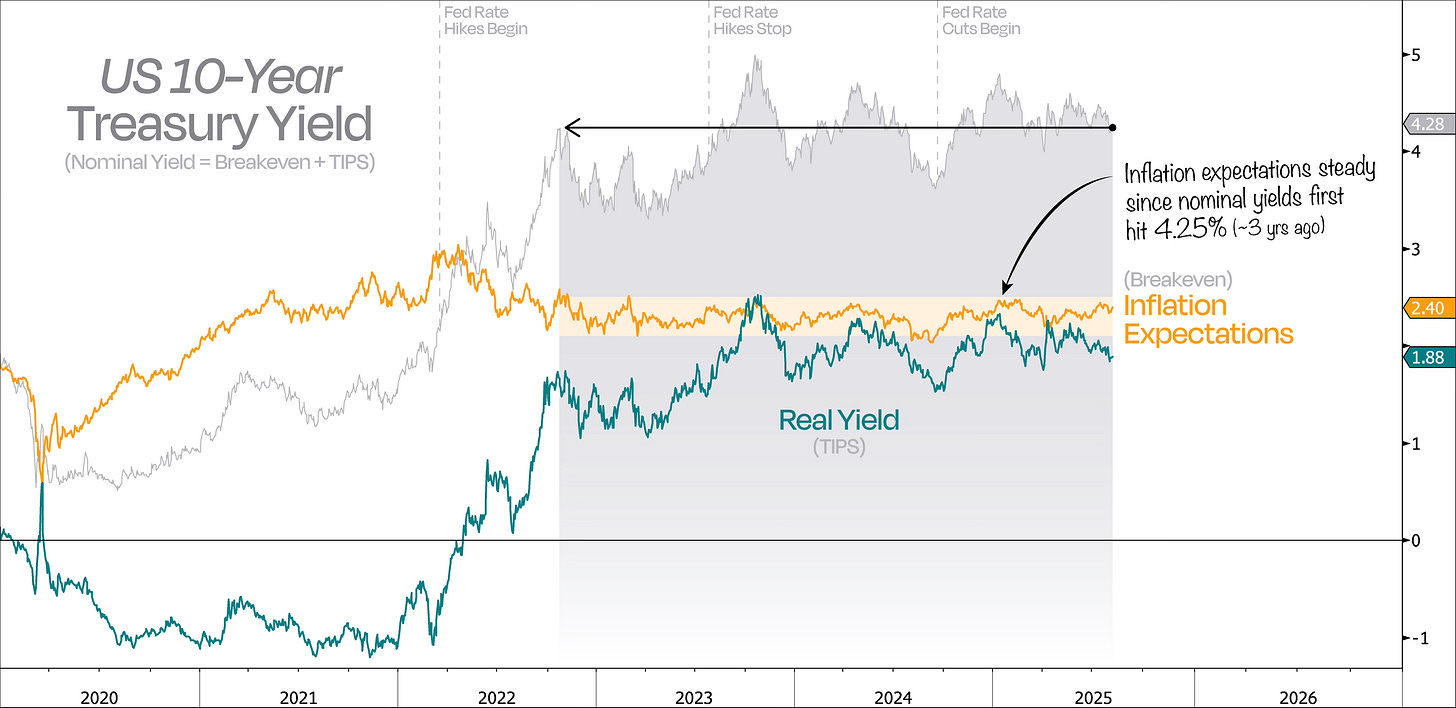

The fact that September may be the kickoff for the next easing wave is primarily driven by a reassessment of the economic outlook reflected in Treasury yields — rather than a meaningful decline in inflationary fears.

What might surprise you is that for the last three years, changes in nominal 10-year yields have mostly come from shifts in real yields, not from inflation expectations.

Right now, the 10-year yield is sitting around 4.25%. We went back to when it first hit this level — in October 2022 — and since then, inflation expectations have pretty much stayed in a tight range, only moving about 40 basis points, as you can see in the chart below.

What this tells us is that investors haven’t really changed their inflation view, they still trust the Fed to keep things under control, and they’re not buying into any “long-term de-anchoring” story (the 5y5y swaps back that up).

That’s why most of the moves in nominal yields have been through the real rate channel, not a change in the inflation story.

For us, it’s a sign of macro normalization — where monetary policy credibility is intact, and bond markets are functioning as forward-looking growth barometers, not inflation panic meters.

Keep reading with a 7-day free trial

Subscribe to Duality Research to keep reading this post and get 7 days of free access to the full post archives.