Is a Market Re-Correlation Event on the Horizon?

Thoughts on the Market

It’s hard to believe that the S&P 500 has spent the past 55 trading sessions within 3% of its all-time highs. But the kind of calm and stability we’re witnessing at the index level is really masking a tug-of-war underneath the surface, with wildly divergent moves canceling each other out.

Whether that means the market is broken is up for debate, but the huge shifts across styles and themes are definitely starting to wear on investor sentiment.

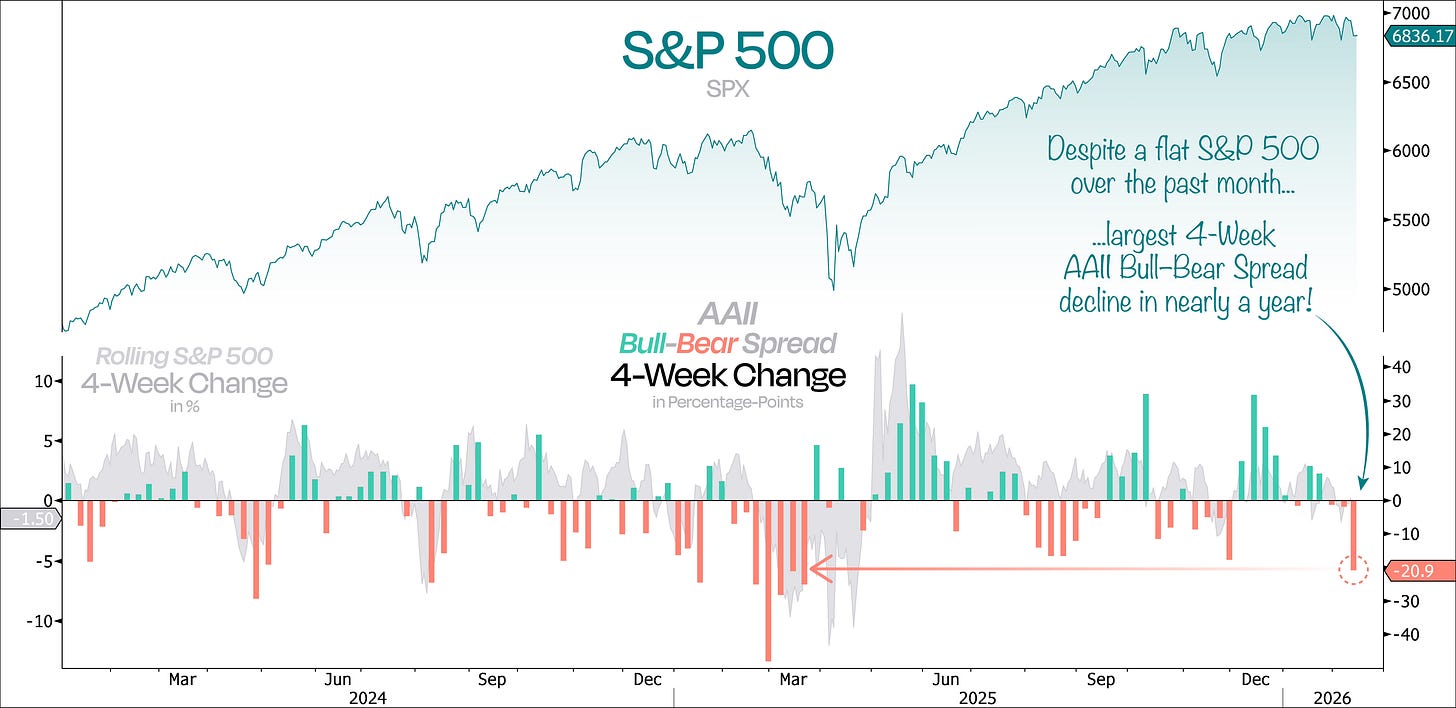

Even though the S&P 500 has gone basically nowhere over the past four weeks, the AAII Bull-Bear Spread just saw its biggest 4-week drop in almost a year.

Given how sharply underlying volatility has surged, this shouldn’t come as much of a surprise.

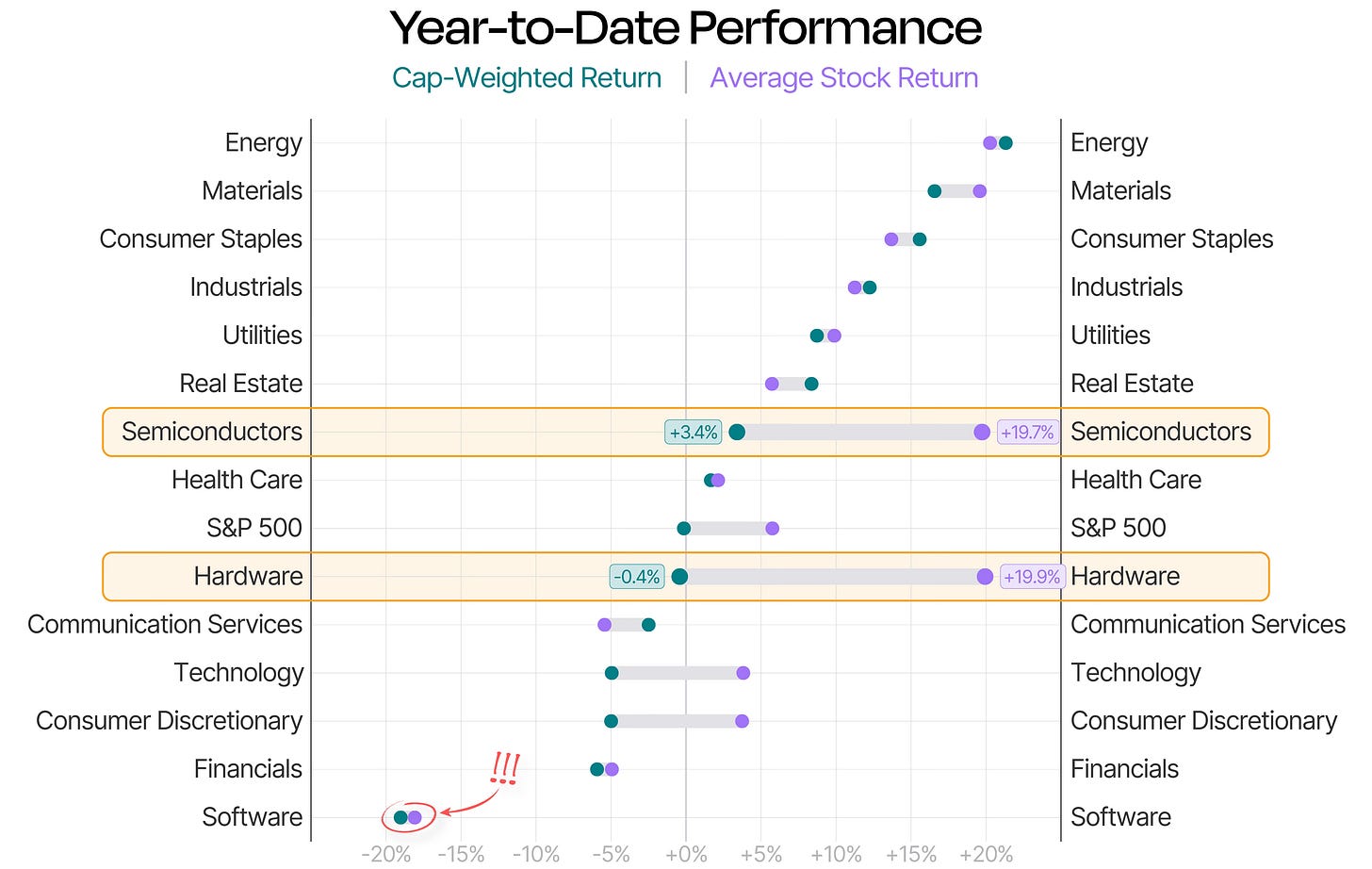

What will surprise many investors, though, is just how bifurcated this market has become. The clearest example is Technology — a sector broadly viewed as not working this year. But once you crack it open and look at Semiconductors, Hardware, and Software separately — and compare cap-weighted returns to how the average stock is actually doing — the dispersion jumps off the page.

On an average-stock basis, Hardware (+19.9%) and Semiconductors (+19.7%) are quietly having monster years, ranking second and third year-to-date — ahead of Materials and just behind Energy.

The main drag on Technology has effectively been Software stocks, including Microsoft, plus the other two heavyweights — Nvidia and Apple.

In short, this has been a stock-picker’s market. Most Tech investors are lagging, but those positioned in the right parts of the sector are outperforming nearly everyone else.

One way to make sense of this market split — as well as the sector-level dispersion we’re seeing — is to look at the macro environment we’re in. And last week’s economic prints made that crystal clear.

Keep reading with a 7-day free trial

Subscribe to Duality Research to keep reading this post and get 7 days of free access to the full post archives.