We’ve seen it all last week – the best, the worst, the biggest... moves, drops, and gains in who knows how long!

If you blinked, you probably missed some of these, as last week had every kind of stat-breaking move you can imagine.

It’s no exaggeration to say we just weathered a Category 5 market storm!

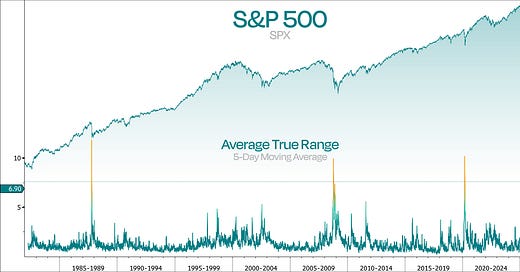

Let’s kick things off with our first chart, which gives a great snapshot of last week’s chaos. We’re looking at the S&P 500 with its Average True Range (aka the market’s heartbeat), and yeah – it was the 4th most volatile week in over 40 years.

Not exactly your average stroll through Wall Street.

That said, things are far from settled. There’s a ton of uncertainty out there, and it could easily get worse before it gets better.

So to get a better read on where things stand, let’s pull up the S&P 500 chart and try to make some sense of this one-manmade disaster.

We’ve talked before about how important that 5500 level was. But ever since Trump hit the red button and basically nuked the economy, we’ve dropped below it and have entered what we’re calling the meat grinder phase – where uncertainty is high, but so is hope.

What’s now priced in is the announcement effect of Liberation Day.

Meaning, everyone’s fully aware of the potential drag on the economy, but pricing in a full-blown recession still feels premature when a single tweet could undo the whole thing.

The real issue now is time. The longer this drags out, the more likely businesses will hit pause on things like Capex, R&D, and M&A – all the stuff that keeps growth ticking.

The same goes for consumers, who will eventually start keeping their hands in their pockets.

This is why a timely resolution is crucial, which would be great for the economy, businesses, and markets. But if it’s too little or too late? Then we’re in for the real pain.

The market would finally have to price in the real effect of these self-inflicted wounds. And if that happens, don’t be surprised to see the S&P dive well below 5000.

Right now, we’re stuck in this weird in-between zone: above the peak right before the 2022 bear market, but still below 5500 – the level that caved when fear and panic took over.

You can see this hesitation in credit spreads too.

Investment grade spreads have moved above 100 bps, but they’re still low compared to history. Honestly, you’d expect them to be pushing 125+ by now.

High yield spreads have widened more, sitting at 419 bps, but that’s still not screaming crisis – just hovering around the long-term average.

With US Treasuries being questioned as a safe haven right now, credit spreads might not be as reliable when bond vigilantes are active.

If we look to our next chart, our own risk-on/risk-off indicator has been flashing red for some time now, which makes total sense given what went down last week.

Trump’s global tariff policies are under some serious pressure – and the bond market’s proving to be the bigger bully in the room.

Last week, swap spreads already gave the President the finger, causing Trump to reverse course on most tariffs with a 90-day pause:

"I was watching the bond market. The bond market is very tricky. I was watching it. But if you look at it now, it’s beautiful. The bond market right now is beautiful. But yeah, I saw last night where people were getting a little queasy.”

Well, Mr. President, that “beautiful” bond market doesn’t look so pretty now, with the 10-year yield inching closer to 4.6% during Friday’s session.

If you have a recession with yields not bailing you out, you’re no longer in America – we’re talking about emerging markets.

When yields spike and your currency drops, that’s usually a sign for countries under serious stress.

The last time we saw anything like this was in the UK.

So could Trump be heading toward his own “Liz Truss moment”?

Well, there’s no doubt he’s deep in a credibility crisis, and it’s starting to look more and more like he’ll have to fold soon.

Trump’s U-turn already started with that 90-day tariff pause, and over the weekend, he exempted a bunch of Chinese exports from tariffs. Before negotiations even started!

That’s a pretty weird move for someone who’s usually all about tough negotiations. But it tells us one very important thing: we are reaching the limits of US tariff escalation!

The mounting pressure from markets, consumers, businesses, and even his own inner circle is reaching a breaking point, becoming so extreme that the process is now self-correcting.

Weird as it sounds, it’s kind of a good thing to see things like the bond market breaking so quickly – it could help the economy and sentiment bounce back faster.

But with so many unanswered questions, we’re not saying we’re out of the woods just yet.

The possible outcomes are all over the place right now, but we’re starting to think if Bessent can restore some credibility, a big bond trade could be on the horizon.

That’s why we picked up some TMFs last Friday for a trade. And even if things keep going south, we know the Fed’s gonna step in.

Sure, we know they don’t want to cut, since they’re stuck between rising prices from tariffs and slower growth caused by uncertainty that’s freezing hiring and Capex.

But at the end of the day, forget the levels where stocks or bonds are trading – when it comes to market moves, it’s all about bond liquidity.

That’s what will grab the Fed’s attention!

So, where does that leave us?

Like we said in the beginning, there’s no need for us to take out those current lows, as long as they can still fix things by rolling back the tariffs as quickly as they were put in place.

That being said, we don’t even think we’ll reach a point of no return. A solution will probably come before things really spiral out of control.

Even though the tariff situation has been handled poorly, we’re still confident things will turn around quickly. And honestly, Trump knows these policies aren’t sustainable.

As we know him, he’ll probably claim some sort of “victory” and change direction soon enough.

Should he fail to act, the market will handle it – likely causing more volatility though, but downside may still be contained as investors would sense a “put” is near.

In the meantime, we’re stuck in a range – caught between 2 levels that feel pretty far apart.

So, expect some volatility ahead!