It’s kind of wild to think we’ve already made back everything we lost during the big 2025 selloff.

If there’s one thing this wild ride reminded us of, it’s that things are never as bad as they seem — and never as good either. That’s a pretty decent way to think about the market in general.

The truth is, there are just too many people out there spinning stories just to get your attention. They’re not trying to help you make smarter investing decisions — they just want your clicks, your views, your time. That’s it. And the more dramatic the narrative, the better (for them).

If you’re still not convinced, just look at this eye-catching chart. They were literally telling you to sell your stocks after the market had already bottomed. Meanwhile, what came next was one of the fastest recoveries in market history.

That’s the game. You win by not falling for the traps set by these so-called journalists.

Similar can be said about Wall Street strategists, though these guys are almost always late because their job is to react, not predict. That’s why, at the end of the day, it’s all about tuning out the noise and staying focused on what really matters: price action.

That said, last week’s trading action was strong. We got a bullish weekly engulfing candle, and the VIX closed below its 10-day moving average by Tuesday — so we closed out the rest of our hedges.

It’s crazy to think that not even a hawkish FOMC or rising Middle East tensions could hand bears a win. And that really says a lot about this market.

The speed of this recovery is sending an overwhelmingly bullish message. But, as is often the case, quick recoveries like this tend to make people nervous. Yet, if you take the time to look at the data, you’ll see that it tells a different story.

Whenever the S&P 500 or Nasdaq 100 rebounds from a 20% drop to a new 52-week high in under three months, those rallies usually keep going — and often by a lot over the next year.

This is exactly the kind of setup where investors tend to get caught off guard. The gut reaction is, “This makes no sense,” so many end up selling too early — only to chase the rally higher later. A classic example of markets climbing a wall of worry.

We’re not in that camp. From where we’re sitting, a lot does make sense right now.

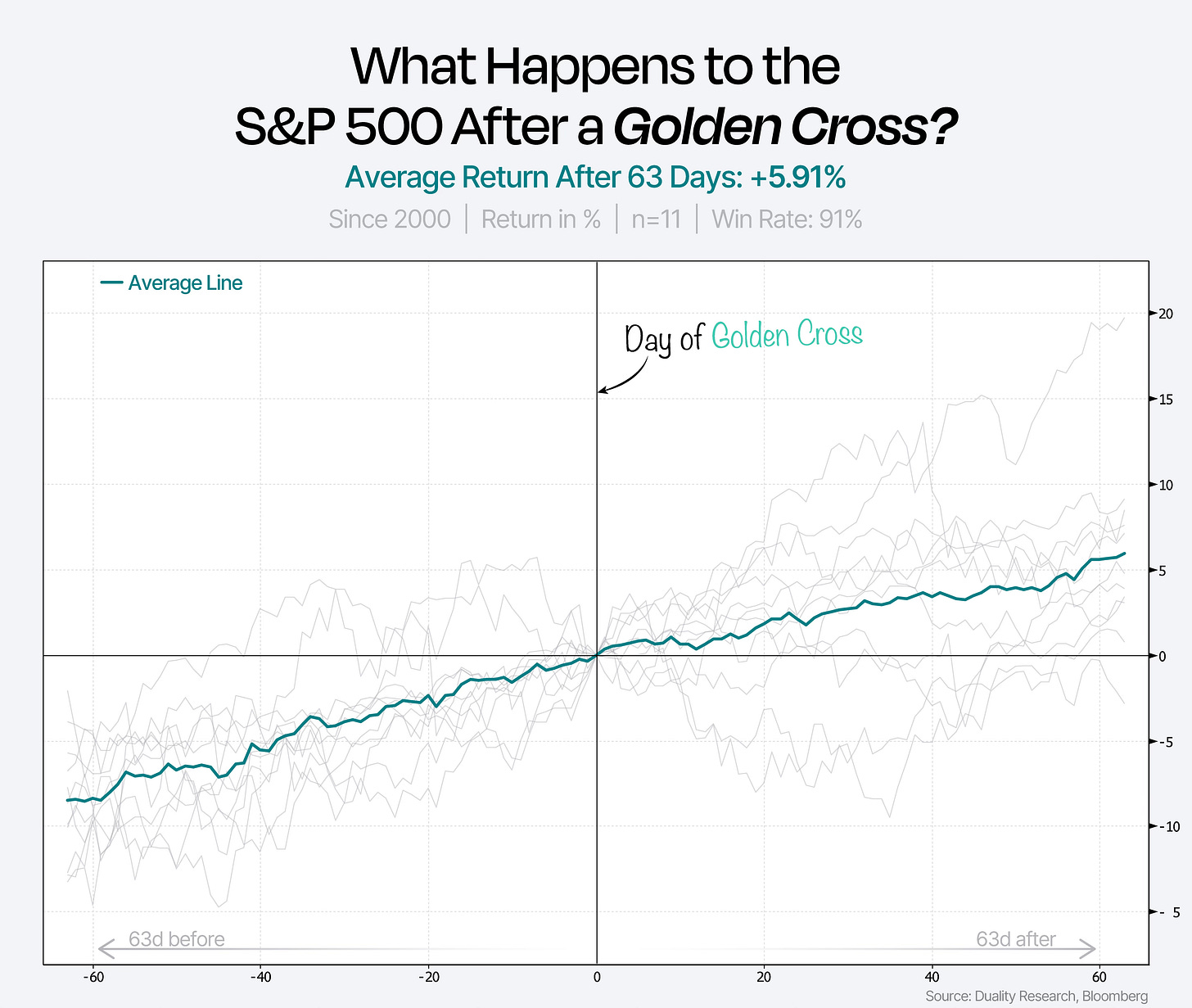

Just last week, the Nasdaq 100 saw its 50-day moving average cross above the 200-day — a classic golden cross and a strong signal of bullish momentum.

Trend conditions are clearly improving, and with the S&P 500 about to follow with its own golden cross, history suggests we could see above average returns over the next three months.

Now, today wraps up the first half of 2025, and we’re heading into July — which, fun fact, has been the best month for both the S&P and Nasdaq over the past 20 years. On average, the S&P is up around 2.5% in July, and the Nasdaq 100 does even better with a 3.8% gain.

Check out the seasonality trends for the S&P 500 below.

While stocks are breaking out, gold is breaking down.

Momentum in gold just hit its lowest level of the year, suggesting the $3,500 April high may have marked a short-term top.

With gold having recently acted more like a risk-off hedge, its weakness makes sense in this growing risk-on backdrop.

Another thing backing this rally is the rebound in earnings estimates.

Forward 12-month EPS estimates just hit an all-time high above $280. For us, not really a huge surprise, given that analysts aren’t in the business of predicting – they’re in the business of reacting.

We were already expecting this back in early May when the rebound was already well underway.

Now, aside from the fact that global liquidity is rising fast, we think the biggest fuel for more upside is still positioning — or really, the lack of it, especially in US stocks.

What we’re seeing fits the classic pattern of major market bottoms, where a lot of investors turn super skeptical.

Take a look at the next chart showing hedge funds and large speculators’ net positions in S&P 500 futures. Not only is it back to levels we haven’t seen since early 2024, but it also shows the usual “smart money” mistake: doubling down on short bets just after the market has already hit bottom.

Keep reading with a 7-day free trial

Subscribe to Duality Research to keep reading this post and get 7 days of free access to the full post archives.